Omnichannel Opportunities to Inform and Educate Customers: Finance

In our world of rapid technological advances and shifting consumer expectations, the financial industry, particularly credit unions, faces a persistent challenge: ensuring customers are fully aware of the range of services available to them. Despite offering a broad spectrum of products designed to meet various financial needs, many credit unions find their members only partially engaged with (or even aware of) these offerings.

This gap necessitates a strategic approach to communication — one that leverages the power of omnichannel opportunities to inform, educate, and engage customers. In this article, you’ll find a concise overview of omnichannel strategies applicable to credit unions and other financial institutions, including relevant technology, challenges to consider, and steps for implementing an effective omnichannel strategy.

The Current State of Customer Awareness in Credit Unions

Credit unions pride themselves on a member-centric philosophy that offers personalized financial solutions. However, a common hurdle is the underutilization of services by members who may only engage with a fraction of what is available. This challenge is not unique to credit unions. It spans the broader financial services industry, where the depth and breadth of services often remain partially hidden from a significant portion of the customer base.

Understanding Omnichannel Communication

Omnichannel communication transcends the traditional multichannel approach by providing a cohesive, integrated customer experience across all platforms and touchpoints. Unlike multichannel strategies that operate in distinct lanes, omnichannel strategies ensure consistency and continuity whether the customer is online, on a mobile app, or in a physical branch. This seamless integration is crucial for educating customers about available services and engaging them on their terms.

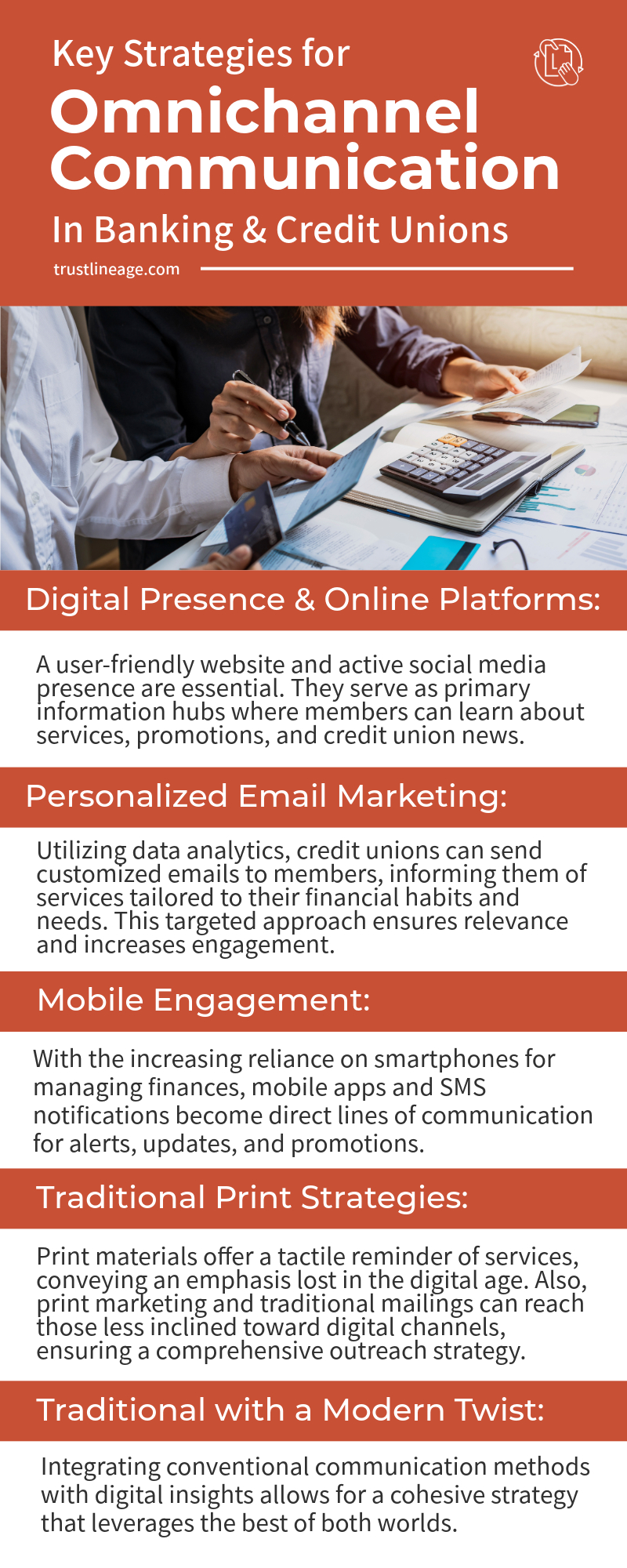

Key Omnichannel Communication Strategies for Credit Unions

- Digital Presence and Online Platforms: A user-friendly website and active social media presence are essential. They serve as primary information hubs where members can learn about services, promotions, and credit union news.

- Personalized Email Marketing: Utilizing data analytics, credit unions can send customized emails to members, informing them of services tailored to their financial habits and needs. This targeted approach ensures relevance and increases engagement.

- Mobile Engagement: With the increasing reliance on smartphones for managing finances, mobile apps, and SMS notifications become direct lines of communication for alerts, updates, and promotions.

- Traditional Print Strategies: Print materials offer a tactile reminder of a credit union’s services, conveying a sense of gravity often lost in the fleeting nature of digital advertisements. Also, print marketing and traditional mailings can reach those less inclined toward digital channels, ensuring a comprehensive outreach strategy.

- Traditional Channels with a Modern Twist: Integrating conventional communication methods with digital insights allows for a cohesive strategy that leverages the best of both worlds. For instance, institutions can customize direct mail campaigns based on online behavior or preferences.

Integrating Technology for Seamless Omnichannel Experiences

The backbone of an effective omnichannel strategy is the technology that supports it.

Customer Relationship Management (CRM) systems and analytics tools are pivotal in understanding customer behaviors, preferences, and needs. This insight allows for crafting messages that resonate across all channels, ensuring a unified and personalized member experience.

However, crafting the perfect message only matters if the customer receives it. Document Management Software ensures you deliver the right message to the right person. In addition, with the right document management solution, you can customize message delivery methods to match a member’s preferred communication channels, increasing open rates and engagement.

Integrating Customer Experience Management (CXM) with existing technologies like CRM systems and document management software ensures interactions across all touchpoints are consistent and personalized. CXM tools enable real-time analysis of member feedback, allowing credit unions to dynamically adjust their outreach to meet evolving expectations, thus enhancing member satisfaction and deepening engagement through tailored communication.

Challenges and Considerations

Despite the clear benefits, implementing an omnichannel approach comes with challenges, including integrating the different technologies, aligning internal teams, and managing consistent messaging across all channels. Moreover, maintaining the privacy and security of member data across these channels is paramount. It’s vital that you choose solutions from an experienced partner with a strong reputation for customer service, risk mitigation, and compliance.

Additionally, ensuring consistency while maintaining efficiency poses a significant challenge. Automating workflows can be a highly effective solution to this issue, as it streamlines processes, reduces the potential for error, and ensures that all members receive a uniform experience regardless of how they interact with your credit union. Automation not only enhances operational efficiency but also allows staff to focus on higher-value tasks, such as member service and engagement, further improving the overall customer experience.

Steps to Implementing an Effective Omnichannel Strategy

- Audit Current Channels: Assess how you use current communication channels and identify gaps in consistency and coverage.

- Understand Your Members: Leverage data analytics to gain insights into member behaviors and preferences.

- Prioritize Appropriate Channels: Considering member preferences and your institution’s capacity to maintain consistent and quality engagement across platforms, choose to prioritize channels where you have the infrastructure and resources to deliver messages effectively.

- Integrate Technology Solutions: Invest in CRM, CXM, and document management software that streamline communication across channels.

- Train Your Team: Ensure all team members understand the importance of a cohesive omnichannel strategy and their role in its implementation.

- Monitor and Adapt: Continuously monitor the effectiveness of your omnichannel strategy and be prepared to adapt as technology and customer expectations evolve.

Omnichannel communication is more than a strategy for enhancing service awareness among credit union members; it’s a comprehensive approach to member engagement that speaks to the evolving landscape of financial services. By ensuring consistent, personalized communication across all channels, credit unions go beyond simply informing members about the services available; they deepen those relationships, fostering loyalty and satisfaction. As the financial services industry continues to evolve, adopting omnichannel strategies will play a critical role in shaping the future of customer engagement.

For credit unions and financial institutions ready to bridge the gap in service awareness and engagement, the journey begins with a commitment to omnichannel excellence. Assess your current strategies, consider the benefits of an integrated approach, and take the first step toward transforming how your services are communicated and experienced.

The path to informed, engaged members is through a strategy that is as dynamic and interconnected as their financial needs. Embrace the omnichannel approach to ensure every member interaction is an opportunity to educate, engage, and elevate your credit union’s value proposition. It’s time to harness the full potential of your communication channels, making every touchpoint a testament to your commitment to member service and satisfaction. Start today and redefine what it means to connect with your members in the digital age.

Discover Omnichannel Strategies For Your Business With Lineage Accelerate

A cornerstone of effective omnichannel communication is the ability to tailor messages to your members’ specific needs and preferences. By leveraging data analytics, credit unions can segment their audience and personalize messages, making each communication more impactful. By implementing automation and updating your document control systems, you can increase your bottom line and business efficiency at the same time.

Lineage Accelerate’s document management solutions offer a way to customize communications, ensuring members receive relevant information that resonates with them. When working with Lineage Accelerate, you benefit from intelligent customer data software to help you transform your business communication to new levels, and you get the most cost-effective mailing and postage rate for your traditional print mailing needs.

Schedule a strategy session with Lineage Accelerate, and begin transforming your business communication into a successful omnichannel strategy today.