Streamline Customer Outreach in Banking with Mail Outsourcing

In the vast financial industry, banks and similar institutions are increasingly facing the challenge of members being fully aware of the financial capabilities that are available to them. Despite offering diverse products and services designed to meet their members’ needs, community financial providers, such as credit unions, find it even more difficult to inform their members of the full breadth of their advantageous wealth services. To remain competitive, banks, credit unions, and similar financial institutions must leverage dynamic and intelligent communication methods to bridge the knowledge divide.

This article dives into mail outsourcing as a unique solution for helping to close the awareness gap, offering a way to streamline outreach efforts and enhance service visibility and member engagement. We will discuss service visibility, the advantages and challenges of mail outsourcing for financial institutions, and steps to implement a successful mail outsourcing strategy.

The Importance of Service Awareness

Service awareness is more than just an operational goal for credit unions; it’s a cornerstone of member satisfaction and loyalty. Knowledge of available services directly impacts a member’s ability to fully engage with their credit union, affecting their overall satisfaction and the likelihood of utilizing additional products. However, credit unions and similar financial institutions often encounter barriers to effective communication, including resource constraints and needing to reach a diverse member base with varying preferences for receiving information.

What is Mail Outsourcing?

Mail outsourcing involves partnering with external providers to manage and execute mail-related tasks, including print-to-mail services, presorting, and direct mail campaigns. This approach allows credit unions to delegate the intricacies of mail management to specialized providers, helps messages be shared efficiently, and delivers them in a way that meets the highest standards of professionalism and compliance.

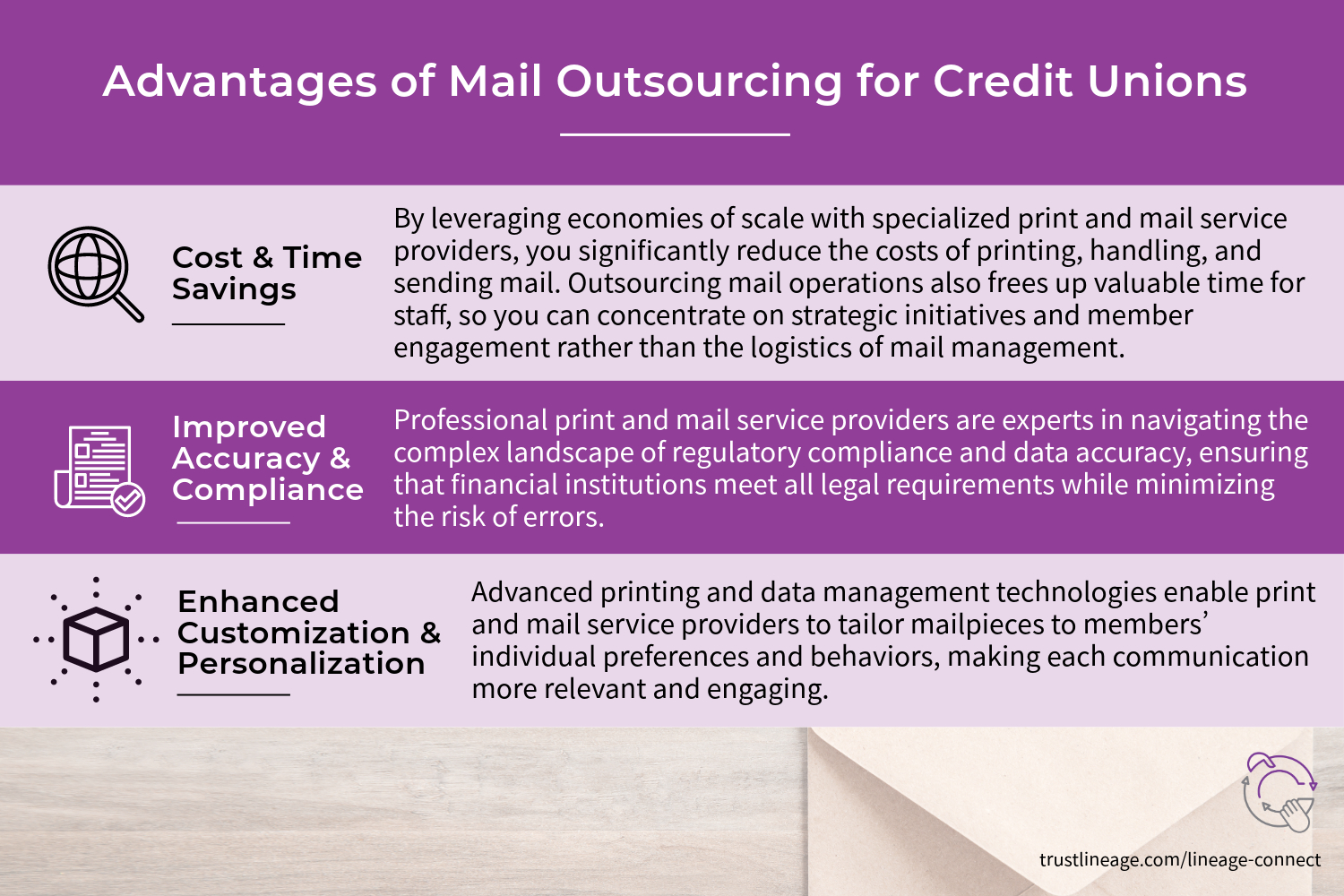

Advantages of Mail Outsourcing for Credit Unions

- Cost Efficiency: By leveraging economies of scale inherent to specialized mail service providers, credit unions can significantly reduce the costs of printing, handling, and sending mail. This efficiency translates into more resources for core member services and product development.

- Time Savings: Outsourcing mail operations frees up valuable time for credit union staff, allowing them to concentrate on strategic initiatives and member engagement rather than the logistics of mail management.

- Improved Accuracy and Compliance: Professional mail service providers are experts in navigating the complex landscape of regulatory compliance and data accuracy, ensuring that credit unions meet all legal requirements while minimizing the risk of errors.

- Enhanced Customization and Personalization: Advanced printing and data management technologies enable service providers to tailor mail pieces to members’ individual preferences and behaviors, making each communication more relevant and engaging.

Integrating Mail Outsourcing into an Omnichannel Strategy

In today’s digital age, integrating mail outsourcing into an omnichannel communication strategy offers a compelling way to enhance member engagement. While digital channels are essential for reaching members quickly and efficiently, physical mail adds a tangible dimension to the member experience. Together, these approaches make sure that credit unions can connect with members across all preferred touchpoints, reinforcing service awareness and creating deeper relationships.

Challenges and Considerations

Choosing the right mail outsourcing partner is critical, requiring due diligence to guarantee that providers have a strong track record in the financial services industry, particularly in handling sensitive information securely. Additionally, so that every piece of communication aligns with the credit union’s identity and values, credit unions must work closely with their partners to maintain brand consistency across all mail materials.

Steps to Implementing Mail Outsourcing

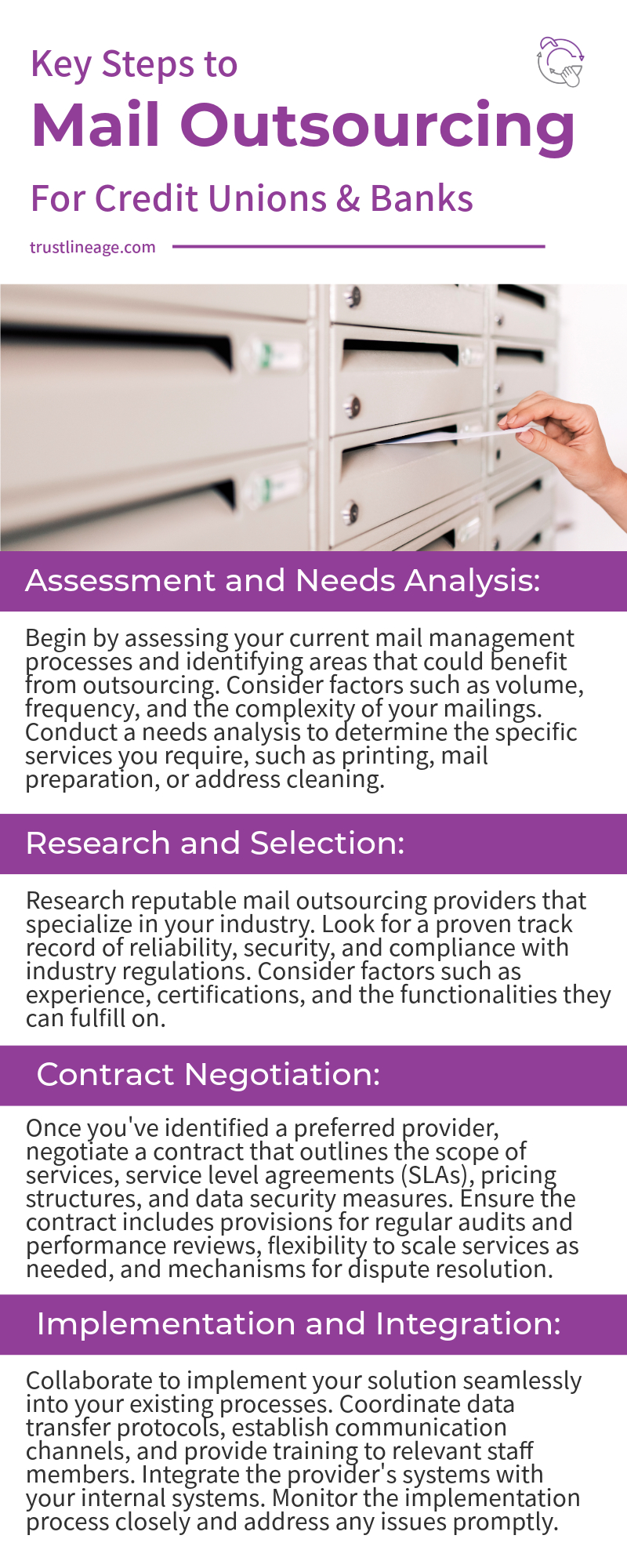

Embarking on a mail outsourcing initiative involves several key steps, from conducting a comprehensive review of current communication practices to selecting a partner that aligns with the credit union’s operational needs and strategic goals. Through careful planning and execution, credit unions can integrate mail outsourcing into their marketing strategies, enhancing their ability to inform and engage members. If you’re considering outsourcing your mail, you can use these steps to know what to expect:

- Assessment and Needs Analysis: Begin by assessing your current mail management processes and identifying areas that could benefit from outsourcing. Consider factors such as volume, frequency, and the complexity of your mailings. Conduct a needs analysis to determine the specific services you require, such as printing, mail preparation, address cleaning, or tracking capabilities.

- Research and Selection: Research reputable mail outsourcing providers that specialize in serving financial institutions like credit unions. Look for providers with a proven track record of reliability, security, and compliance with industry regulations. Consider factors such as experience, certifications, and the functionalities they can fulfill on. Request proposals and compare offerings to select the provider that best aligns with your needs and budget.

- Contract Negotiation: Once you’ve identified a preferred provider, negotiate a contract that outlines the scope of services, service level agreements (SLAs), pricing structures, and data security measures. Ensure the contract includes provisions for regular audits and performance reviews, flexibility to scale services as needed, and mechanisms for dispute resolution. Work closely with legal and procurement teams to finalize the contract terms.

- Implementation and Integration: Collaborate with your chosen provider to implement the outsourced mail solution seamlessly into your existing processes. Coordinate data transfer protocols, establish communication channels, and provide training to relevant staff members. Integrate the provider’s systems with your internal systems for streamlined workflow and data exchange. Monitor the implementation process closely to address any issues promptly and ensure a smooth transition.

Mail outsourcing offers banks and credit unions a strategic tool for improving service awareness among their members. By partnering with a specialized provider, you can enjoy the benefits of streamlined operations, cost savings, and enhanced member communication. As part of a broader strategy to connect with members and inform them of available services, mail outsourcing is a practical, optimized solution.

What Mail Outsourcing Looks Like with Lineage Connect

Discover Customer Outreach and Mail Outsourcing Solutions with Lineage Connect

Knowing that your credit union members are fully informed about the range of services available is essential for fostering satisfaction and loyalty. Mail outsourcing emerges as a powerful solution to bridge the knowledge gap, offering operational efficiency, bottom-line savings, and enhanced member communication. By partnering with Lineage Connect, credit unions and financial institutions can leverage specialized expertise and technology to streamline mail delivery processes.

With Lineage Connect, we offer guaranteed professionalism, improved accuracy, and advanced security every step of the way.

To discover how Lineage Connect’s tailored solutions can transform your outreach efforts and elevate member engagement, contact us today. Unlock the potential of outsourced mail solutions and empower your credit union or banking institution to thrive in the competitive financial landscape.